premium finance life insurance definition

This arrangement involves an outside third party lending sources like a bank or hedge fund paying the premiums on a life insurance contract. The price depends on the type of insurance you buy such as life auto or renters.

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Typically the financing company would pay for premium and charge the insured on a monthly repayment plan.

. The idea is that the return on. If there is a loan balance at the clients death part of the life insurance death benefit would repay the loan and the remainder would go to the clients beneficiaries. Ad Life Insurance You Can Afford.

A life insurance premium is a payment made to the life insurance company to pay for a life insurance policy. Premium payments are required to be made to the insurance company. A Premium Deposit Account also referred to as premium deposit fund was designed for life insurance applicants who want to deposit a considerable amount of money in a life insurance policy that will earn interest and eliminate the possibility that the insurance policy could become a modified endowment contract MEC.

Apply for life insurance from New York Life and join AARP at the same time. The premium finance company will take care of the. A financed premium refers to a loan provided by a third party to a company or individual to cover the individuals insurance premiums.

However insurance companies and insurance brokerages occasionally provide premium financing services through premium finance. Ad Coverage from 10000 to 100000. Insurance premium financing is similar to other types of loans.

Your insurance history where you live and other factors are used as part of the calculation to determine the insurance premium price. Insurance premiums will vary depending on the type of coverage you are. Since the PDA is a transaction between.

Often the insurer or brokerage offer such financing options as well. Premium financing has been around for years in the life insurance industry and has been heavily promoted especially among wealthier clients. Instead of making payments directly to the insurance carrier the insured will work with a premium finance company.

What exactly is premium financed life insurance. Premium finance loans are often provided by a third party finance entity known as a premium financing company. For example if Sally purchased a 10-year level-premium policy.

Premium financed life insurance can be a cost effective way to purchase needed life insurance. If your car insurance has a 100. What Does Financed Premium Mean.

Premium financing is a way for qualified borrowers to use third-party financing to pay for hefty life insurance premiums. An insurance premium is the amount you pay for an insurance policy. No Medical Exam - Simple Application.

Today in light of the relatively low interest rate environment premium financing may be a practical and appropriate way to assist individuals who have a legitimate need to purchase life insurance for estate planning or business needs. Ad See How Group Term Life Insurance Can Help Protect You Loved Ones for Years to Come. A deductible is an amount you have to pay before your insurance company initiates coverage.

Protect the Ones You Love With Competitive Group Term Life Insurance From WAEPA. The premium amount is determined by a number of variables including your age. In the right circumstances financing life insurance policy premiums may provide a client with a better internal rate of return than paying premiums out of pocket.

Structured properly it provides a flexible alternative way to manage assets and cash flow. For example if your car insurance premium is 800 per year you must pay your insurer 800 per year to have the insurance. The insurance premium is the amount of money paid to the insurance company for the insurance policy you are purchasing.

Although premium financing may seem like a simple concept it actually involves complex transactionsand risk. If Sally wants to keep her premium the same throughout the life of the contract she would select a level-premium insurance policy. A premium is the price of the insurance youve chosen charged by your insurance company.

Different kinds of life insurance carry fixed or adjustable premiums. Definition of an Insurance Premium Insurance premiums are the monthly or annual or other interval payments you make to an insurance company for life insurance coverage. You can take a loan out against the cash value and.

As Low As 349 Mo. The premium for a life insurance policy is calculated using illustration software provided by the insurance company. One way to look at the premium payment is as the cost of the life insurance but the cost of insurance and the premium due are not always the same amount due to things like dividends.

Premium finance is a strategy where policyowners will pay massive life insurance premiums in conjunction with borrowing from a third-party lender rather than tying up their own capital. Learn about the benefits of becoming an AARP member. The policyholder repays the lender for the amount of the loan amount financed plus interest and any assessable fees and charges.

Premium Finance A process wherein a lender pays an insurance premium to an insurer on behalf of an insured. Whole life insurance policies have fixed premiums and a cash value component that slowly accumulates. Definition Premium Loan an amount borrowed against the cash value of a life insurance policy to make a premium payment allowing the policy to stay in force.

Premium financing can be a valuable tool for high-net-worth individuals who need life insurance but dont want to tie up capital. No Medical Exam - Simple Application. Just like how the wealthy expect extremely favorable loan terms to purchase real estate they are often offered sweetheart loans to purchase large amounts of life insurance instead of paying.

Premium financing is often used when a life insurance policy is owned by an entityfor example an irrevocable life insurance trust ILITwhich may not have enough cash or assets to make large premium payments. Premium financing is the lending of funds to a person or company to cover the cost of an insurance premium.

When Young You Are Young And Healthy Plus Your Premiums Are On The Lower Side Insuranceagent254 Financialgoals Insurancesimpli Seguro De Vida Vida

Variable Universal Life Insurance Authentic Counsel Llc Life Insurance Beneficiary Universal Life Insurance Life Insurance For Seniors

3 Ways To Generate Life Insurance Leads Life Insurance Marketing Life Insurance Sales Life Insurance Facts

Pin By Jai Dalvi On Life Insurance Life Insurance Quotes Life Insurance Facts Financial Planning Quotes

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Whole Life Insurance Definition

What Type Of Life Insurance Policy Do I Need

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

What Is Life Insurance Exact Definition Meaning Of Life Insurance

The Title Search Process Title Insurance Insurance Homeowner

What Are The Different Types Of Life Insurance We Have The Answer

What Is Life Insurance Exact Definition Meaning Of Life Insurance

The Definition Of Participating Whole Life Insurance Simple Version Whole Life Insurance Permanent Life Insurance Term Life

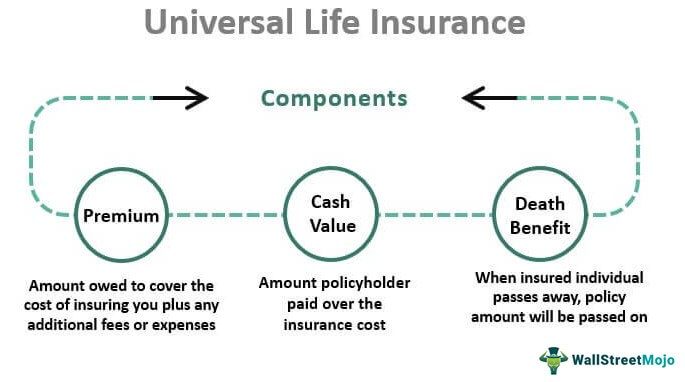

Universal Life Insurance Definition Explanation Pros Cons

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)